Google and nuclear site developer Elementl Power have signed a major deal to build a total of 1.8 gigawatts (GW) of advanced nuclear energy capacity for Google’s growing data operations. The announcement came in May 2025, amid the tech giant’s record $75 billion investment in new data center infrastructure this year. Each of the three planned sites will deliver at least 600 megawatts (MW) of electricity, addressing the booming power demands of Google’s AI-driven operations.

This agreement signals a new momentum for small modular reactor (SMR) projects in the U.S., aiming to ensure that Google data centers stay online with clean, reliable electricity. The move may also set a path for other technology leaders confronting similar energy and sustainability challenges as AI and cloud services scale up. It follows Google’s recent efforts to secure green power contracts and move towards 24/7 carbon-free energy.

Google’s Growing Energy Needs and AI Expansion

Google’s expanding ambitions in artificial intelligence and cloud services are massively increasing its demand for constant, high-capacity power. In 2025 alone, the company budgeted $75 billion solely for building more data center space. Every new AI-powered feature and product means more server racks, faster processors, and around-the-clock workloads – all of which put mounting pressure on the electricity grid.

AI training and inference, especially at Google’s scale, are energy-intense. These operations often require specialized hardware and have to be protected against even minor interruptions in power supply. To stay competitive, Google needs its data centers to run at peak performance no matter the time of day or weather. For this reason, the company has been seeking dedicated power deals across renewables and, now, next-generation nuclear solutions.

The company’s official statements emphasize their commitment to reaching “24/7 carbon-free energy” at every site, every hour. This means not just offsetting grid emissions but ensuring the power running its servers is truly clean – without dependence on fossil fuel peaker plants when solar and wind dip. The scale of Google’s growth means traditional renewables can’t easily guarantee reliability alone, driving the search for innovative, firm sources of clean energy.

The push for more secure energy comes amid broader supply chain strains and rising utility prices, both in the United States and worldwide. With dozens of new data centers planned, Google’s contracts are redefining what tech demand means for next-generation energy investments.

Details of the Google-Elementl Power Nuclear Agreement

The new agreement between Google and Elementl Power covers three separate sites, each expected to add at least 600 MW of nuclear generating capacity to the grid. The total sum – 1.8 GW – would make this one of the largest advanced nuclear initiatives ever announced by a tech company. Elementl Power’s expertise is in site development, grid integration, and working closely with potential utility partners.

Google’s deal provides the option for what’s known as commercial off-take: after the reactors connect to the local grid, Google can buy the electricity directly. This arrangement ensures a steady, dedicated supply of carbon-free electricity flowing straight to its data operations, wrapped in power purchase agreements that can extend for years. The new sites are expected to go live in the second half of this decade, although final decisions on technology and timelines remain.

An important feature is Elementl Power’s “technology agnostic” stance, which means the company isn’t committed to one particular small modular reactor design or vendor just yet. This allows for flexibility as the best emerging nuclear technologies are vetted, licensed, and selected. It also increases competition among reactor firms vying for one of the first major commercial deployments in the U.S. market.

Regulatory approvals will be a key step, especially in the nuclear sector. The collaboration was announced as states and the federal government are reviewing processes for licensing new types of reactors and accelerating advanced nuclear projects. With political and investor support increasing, Google and Elementl aim to complete necessary reviews and break ground before the end of the decade.

The financial backing involves not just Google but also investment groups like Energy Impact Partners, which provide critical funding and industry expertise to scale up these ambitious energy projects.

Who is Elementl Power?

Elementl Power was relatively unknown until this deal with Google was made public. The company’s founders come from Breakwater North, and their experience spans several areas of the nuclear sector, including site acquisition, licensing, and project management. Backed by Energy Impact Partners, Elementl Power operates with a focus on enabling advanced nuclear technologies to deploy safely, quickly, and at scale.

While Elementl hasn’t yet developed or commissioned a power plant of its own, its team brings together skill sets from utilities, regulatory bodies, and innovative reactor startups. According to public filings, the company has quietly acquired or optioned several potential utility-scale sites in the U.S., positioning itself to move quickly as soon as a major commercial partner signs on.

Elementl avoids betting the company on a single technology. Instead, it plays an integrator and facilitator role – connecting land, capital, community relations, and ultimately the best-available SMR or advanced reactor option to meet customer needs. This lowers risk both for itself and for partners like Google who may want input into the technology decision.

The involvement of Energy Impact Partners (EIP) brings credibility and resources. EIP has invested in energy startups, grid tech firms, and now the advanced nuclear space. Their portfolio and network are designed to help clean energy ventures move from lab to real-world, revenue-generating deployments.

Technology Agnostic Approach to Advanced Nuclear

Elementl Power’s commitment to a technology agnostic approach is rare in the conservative world of nuclear energy. This means that instead of choosing a single reactor design up front, the company keeps its options open, evaluating multiple small modular reactor (SMR) vendors and their progress towards licensing, cost, and time-to-market.

This approach aims to maximize both safety and value. By comparing several technologies, Elementl can select the one that best meets Google’s strict requirements for reliability, carbon-free operation, and long-term price stability. The “agnostic” model also creates pressure on suppliers to accelerate innovation and regulatory readiness – not just for Elementl, but for the whole SMR sector.

Choosing among SMR types will depend on several factors:

- Speed and likelihood of regulatory approval

- Capital and operating costs

- Proven safety record and worldwide adoption

- Capability to deliver enough power, consistently

Many technology vendors are racing to have the first U.S.-approved commercial SMR, including Oklo, X-Energy, and Kairos Power. Each one brings its own design philosophy, reactor coolant, and deployment timeline. Elementl’s flexibility helps ensure Google isn’t locked in prematurely and can benefit from industry-wide advances.

The Role of Small Modular Reactors in Google’s Plans

Small modular reactors (SMRs) are at the heart of Google’s and Elementl’s new generation nuclear aspirations. Unlike conventional plants, SMRs are factory-assembled units generally designed to produce less than 300 megawatts per module. Their compact footprint allows them to be sited near data centers – addressing both grid constraints and transmission challenges that large plants face.

SMRs promise several benefits critical to Google:

- Reliable, always-on electricity output

- Faster construction, thanks to modular manufacturing

- Lower up-front capital requirements

- Potentially easier licensing for smaller, safer reactors

For AI and cloud operations, uninterrupted power is essential. SMR projects can be tailored in scale and located in regions where renewables might not always deliver, bridging the “last mile” problem of power supply for high-density tech campuses. SMRs are also promoted by industry advocates as a clean alternative to natural gas, capable of helping Google meet its climate goals even as data workloads soar.

There are still challenges, however. Most designs are awaiting full commercial demonstration outside of countries like China, which has moved ahead on the first grid-connected SMRs. The U.S. hopes to catch up, spurred in part by large tech companies taking visible stakes.

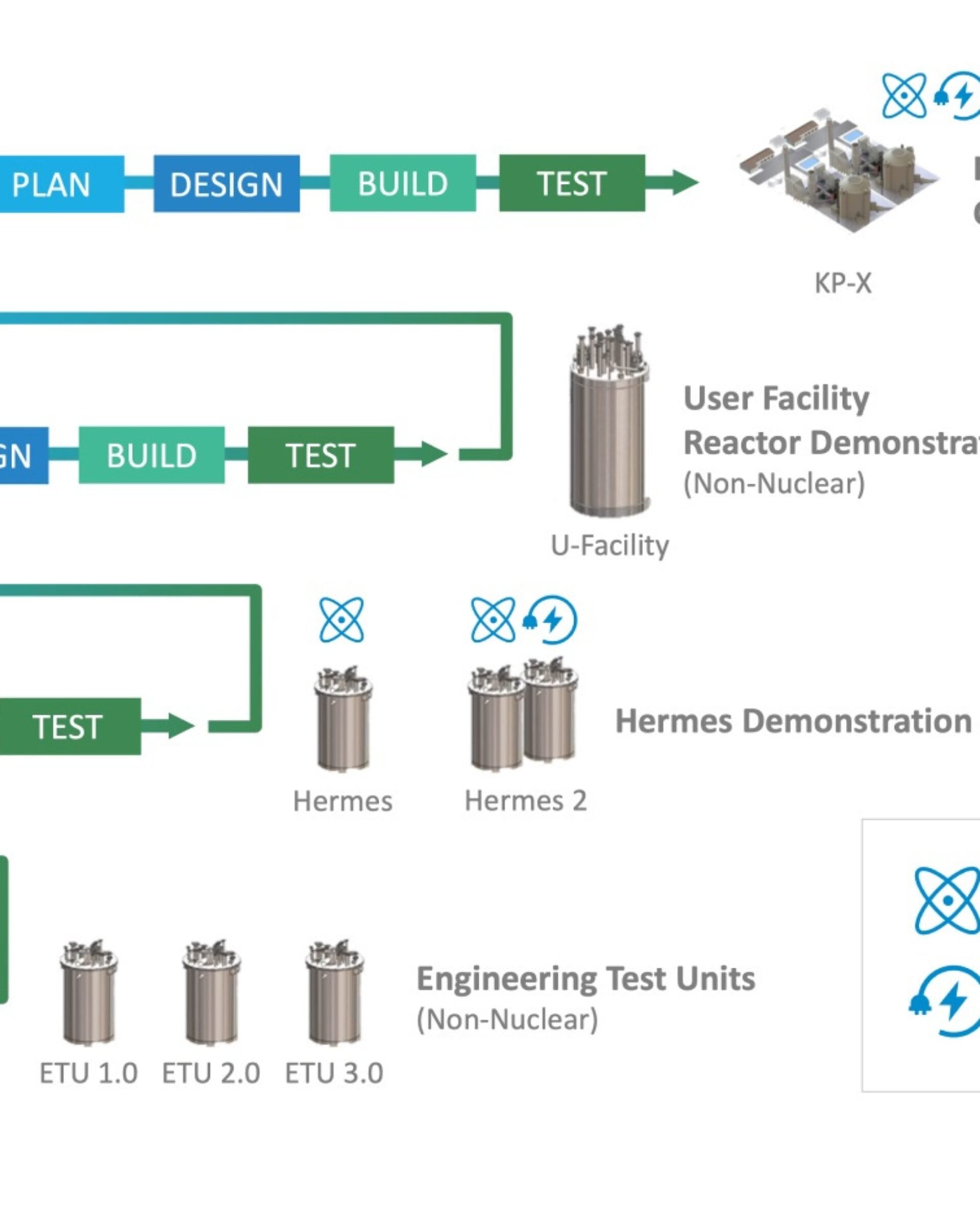

Kairos Power and Potential Technology Partners

One of the most closely watched potential partners is Kairos Power, a company with an established relationship with Google and a focus on high-temperature, fluoride salt-cooled reactors. Kairos Power has announced plans for a demonstration reactor at 50 MW, as well as a scalable commercial system with two reactors totaling 150 MW, making it a likely frontrunner for one of Elementl’s sites. You can find more about their technology directly at the Kairos Power technology page.

Other companies in contention include:

- Oklo: Known for compact, fast reactors with significant backing from investors.

- X-Energy: Specializes in high-temperature gas-cooled reactor designs.

- NuScale: Was considered an industry leader until the cancellation of a high-profile U.S. project in 2023 after cost overruns.

Choosing the best partner will depend on the candidate’s ability to demonstrate safety, commercial readiness, and the ability to scale quickly. Google must weigh risk against readiness; Kairos, with a real pilot plant in play, may hold the edge, but broader negotiations remain ongoing.

The partnerships highlight the competitive race among American SMR developers for the prestige and business advantage of landing the first major tech buyer.

There’s also keen global attention – from governments to universities and investors – on which company will finally deliver a commercially successful SMR outside of China in the coming years.

Also Read

Last Chance to Exhibit at TechCrunch AI Sessions at Berkeley

Comparison: Small Modular Reactors vs Traditional Nuclear Plants

To understand the difference between SMRs and traditional nuclear plants, it’s important to look at output, cost, and deployment. SMRs typically top out at around 300 MW, while large-scale reactors like Georgia’s Vogtle Unit 4 generate more than 1.1 gigawatts (GW) – almost four times the maximum output of a large SMR.

| Plant Type | Typical Output | Deployment Time | Use Case |

|---|---|---|---|

| Traditional Nuclear | 1,100 MW – 1,600 MW | 10+ years | Large grid supply |

| SMR | 50 MW – 300 MW | 5-7 years (target) | Industrial, data centers |

Traditional reactors rely heavily on custom construction and long permitting timelines, which means costs and risks often balloon. SMRs are designed for repeatability – built in factories, shipped to site, and installed quickly. This could drive cost savings over time and help utilities and corporations meet clean energy targets.

There is ongoing debate over whether SMRs can truly overcome the economic and licensing barriers that have stalled big nuclear projects. However, for buyers like Google, even partial progress offers a meaningful improvement over fossil-fueled backup solutions or unreliable renewable-only scenarios at scale.

The decision to invest in SMRs may reshape how large-scale data and cloud services approach their power needs, encouraging more innovations in “firm, clean” energy for mission-critical applications.

Also Read

Florida Encryption Backdoor Bill for Social Media Fails to Pass

Silicon Valley’s Interest in Small Modular Reactors

SMRs have quickly become a focal point for tech sector climate ambitions, especially among Silicon Valley giants. Tech companies are pledging to cut their carbon footprints even as their digital infrastructure grows. This has led to an explosion of new deals and investments in unproven, yet promising, SMR startups.

Several notable Silicon Valley players are signing agreements or taking equity stakes in SMR companies, hoping to accelerate development and secure first-mover advantages on dedicated, clean power contracts. The combination of persistent demand for computing and the pressure to be environmentally responsible has made advanced nuclear an attractive option.

Industry watchers point to the synergy between rapid innovation in tech and the ambition in the SMR sector. Companies like Oklo, X-Energy, and Kairos Power have benefited from tech capital and connections, pushing the nuclear industry into faster cycles of innovation and competition, unlike the slower pace often associated with utility-scale infrastructure projects.

For investors, there’s growing belief that the first company to successfully commercialize SMRs in North America will unlock an enormous market among hyperscale data center operators.

Also Read

Apple’s New Chips Target Smart Glasses, Macs, and AI Hardware

The alliance between tech and advanced nuclear has the potential to reshape both industries, bringing new urgency and funding to one of clean energy’s hardest problems.

Challenges Facing the SMR Industry Outside China

Despite big announcements and high expectations, building SMRs outside China has proven difficult. As of 2025, no SMR has yet operated commercially in the U.S., Europe, or most of the developed world. Startups in the space, such as NuScale, have come close but been held back by rising costs and canceled contracts.

NuScale came the closest to deploying a U.S. SMR, but in 2023 its main utility partner withdrew after cost estimates more than doubled, even with plans scaled back. This high-profile setback underscored how challenging it is to bring new nuclear technology from design to real-world operation – especially in markets with tough regulatory environments and competition from inexpensive natural gas and renewables.

Internationally, China has become the leader by connecting the first grid-scale SMRs, benefiting from central planning, faster regulatory pathways, and government subsidies. Other countries are watching closely, searching for lessons to shorten timelines and reduce risks without sacrificing safety and public trust.

Also Read

Widespread Timeline Issues Hit X as Users Report Outages

Issues facing SMR projects include:

- Long and complex licensing reviews

- Uncertainty about project costs

- Supply chain and skilled labor shortages

- Political and regulatory risk

Until several successful projects are up and running, skepticism from investors and utilities will remain. The hope is that visible progress from deals like Google and Elementl Power will accelerate U.S. breakthroughs.

Why Data Centers are Seeking 24/7 Clean Power

The rise of the always-online internet and AI workloads is making energy reliability more important than ever. Data centers, the backbone of cloud computing, can’t afford blackouts or dips in power. As more services rely on social media, streaming, and real-time AI, even a short outage is unacceptable for users and the businesses that depend on them.

Google and its peers are moving beyond simple renewable energy purchases; now, the aim is 24/7 carbon-free energy – which means powering every server hour with verifiable clean sources, not just offsets. Wind and solar have helped, but their intermittent nature means tech firms need backup options. For mission-critical loads, battery storage, while improving, is still not economically viable at massive scale.

Also Read

Zen Agents by Zencoder: Team-Based AI Tools Transform Software Development

Nuclear, especially SMRs, is seen as a possible answer. These reactors can run continuously, balancing the fluctuations of wind and solar and lowering the need for fossil-fuel “peaker” plants. The reliability and predictable costs of nuclear also appeal to corporate finance officers planning for the long term.

By making data center power a front-and-center issue, tech companies are influencing utilities, regulators, and energy vendors to innovate faster, opening up new opportunities for clean energy breakthroughs.

The Future of Advanced Nuclear Energy in the U.S.

The Google-Elementl Power deal is one of the clearest signals yet that advanced nuclear could play a bigger part in America’s clean energy future. With federal support rising and climate goals mounting, attention is now on whether these projects can overcome industry challenges and get built on time and within budget.

The next steps depend on regulation, financing, and delivery. The U.S. Nuclear Regulatory Commission is streamlining approvals for new reactor types, while Congress and state governments debate incentives or direct investment. How fast Google and Elementl can break ground and begin construction will demonstrate whether tech-sector demand can move the dial or if the sector’s difficulties will continue.

Also Read

CoreWeave Seeks $1.5 Billion Debt Deal After IPO Falls Short

If the projects succeed, expect a surge of interest from other large-scale industrial energy buyers. Not only tech, but manufacturing, pharmaceuticals, and other sectors looking for reliable, green electricity will be watching results closely.

The success or delay of these facilities may influence public opinion and policy, determining whether nuclear becomes a major solution for U.S. clean energy targets or remains a niche player alongside solar and wind. For now, the sheer scale of new data center investment is forcing conversations about what’s possible – and what’s necessary – for America’s energy future.